Additionally, a fund is more likely to produce short-term capital gains, which are taxed at the investor’s regular income rate, the more the portfolio is turned over. The turnover ratio is the best indicator of how much buying and selling goes on within a fund. Due to the spreads and commissions that must be paid when buying and selling equities, high turnover frequently results in increased expenses for the fund these charges influence the fund’s total return. A young woman checks her phone while at her desk at home. The turnover ratio has no intrinsic significance as a technical indicator neither high turnover ratios nor low turnover ratios are inherently “good” or “poor.” However, investors need to be wary of the effects of frequent turnover. Consider these top brokers if youre looking to invest in mutual funds. Compared to a large-cap value stock fund, an aggressive small-cap growth stock fund typically has higher turnover.

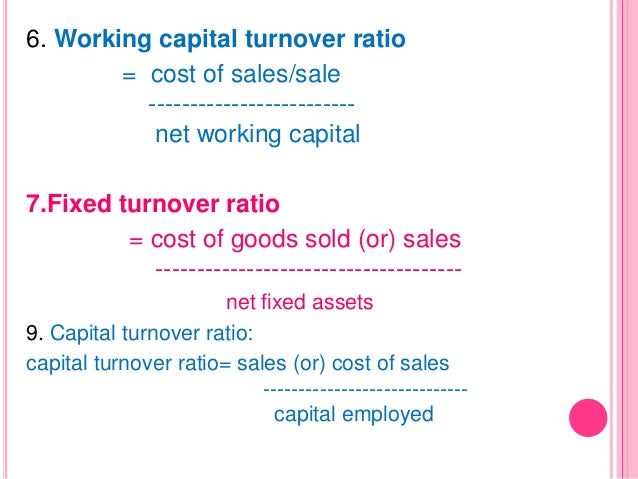

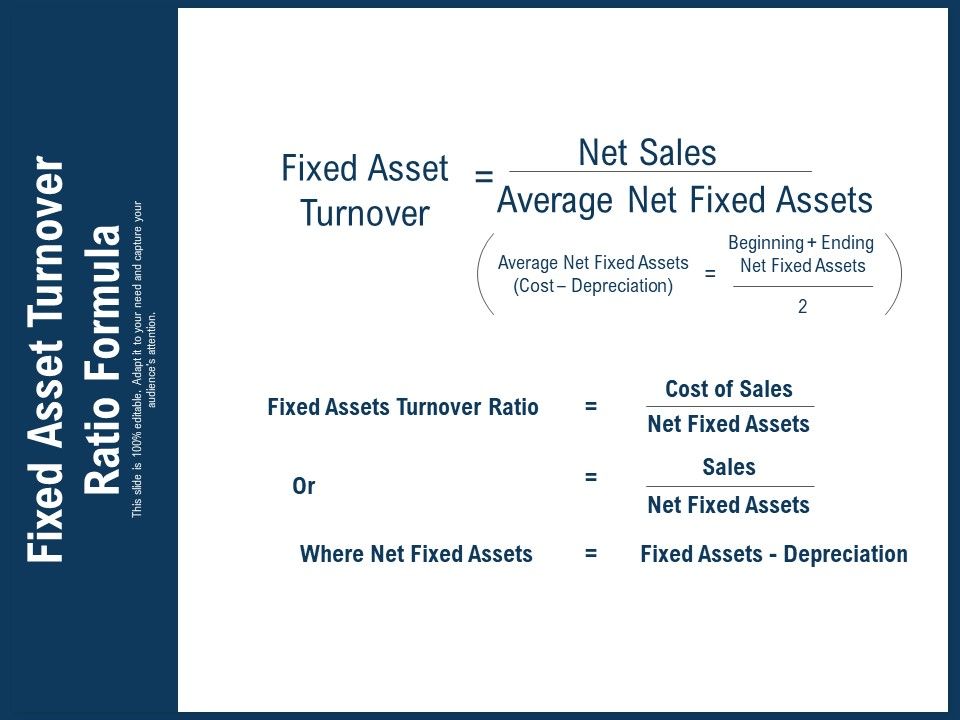

Buy-and-hold investing is reflected in actively managed mutual funds with low turnover ratios, whereas market timing is attempted in those with high turnover ratios. I split the 407 funds into the following groups based on how much they trade their assets: 0-14 turnover rate (16 funds), 15-24 (43), 25-49 (155), 50-74 (88), 75-109 (59), 110-7,000. The accounts receivable turnover ratio is net credit sales divided by average accounts receivable. On the other hand, as bond investments are characterized by vigorous trading, a bond fund will frequently see substantial turnover. The inventory turnover ratio is the cost of goods sold divided by the average inventory. For instance, a stock market index fund often has a low turnover rate because it replicates a specific index and index component businesses don’t change all that frequently. A fund with a higher turnover ratio purchases and sells more stocks, bonds, and other financial instruments during a given period than a fund with a lower. A higher turnover ratio indicates that the fund is. The turnover ratio varies depending on the type of mutual fund, its investment goal, and investing approach used by the portfolio manager. The turnover ratio in mutual funds measures how often the portfolio of securities the fund holds are traded.

The ratio aims to represent the percentage of stocks that have changed over the course of a year. However, just because a portfolio’s turnover percentage is higher than 100% doesn’t mean every holding has been replaced. Some funds maintain equity positions for fewer than 12 months, which indicates that their turnover ratios are higher than 100%. A mutual fund that invests in 100 equities and replaces 50 of them in a year, for instance, has a turnover ratio of 50%. The percentage of investments in a mutual fund or other portfolio that have been replaced over the course of a year (either the calendar year or the 12-month period that corresponds to the fund’s fiscal year) is known as the turnover ratio or turnover rate.

0 kommentar(er)

0 kommentar(er)